🏦Governance Token

Our main goal with our governance token design is to maintain simplicity.

A total of 21,000,000 governance tokens will be minted. This figure is an industry standard and is a nod to the original Bitcoin limit. Utilizing a clear-cut 1:1 supply ratio allows us to streamline the evaluation of projects value, linking our governance token's fraction/ratio directly to the original store of value.

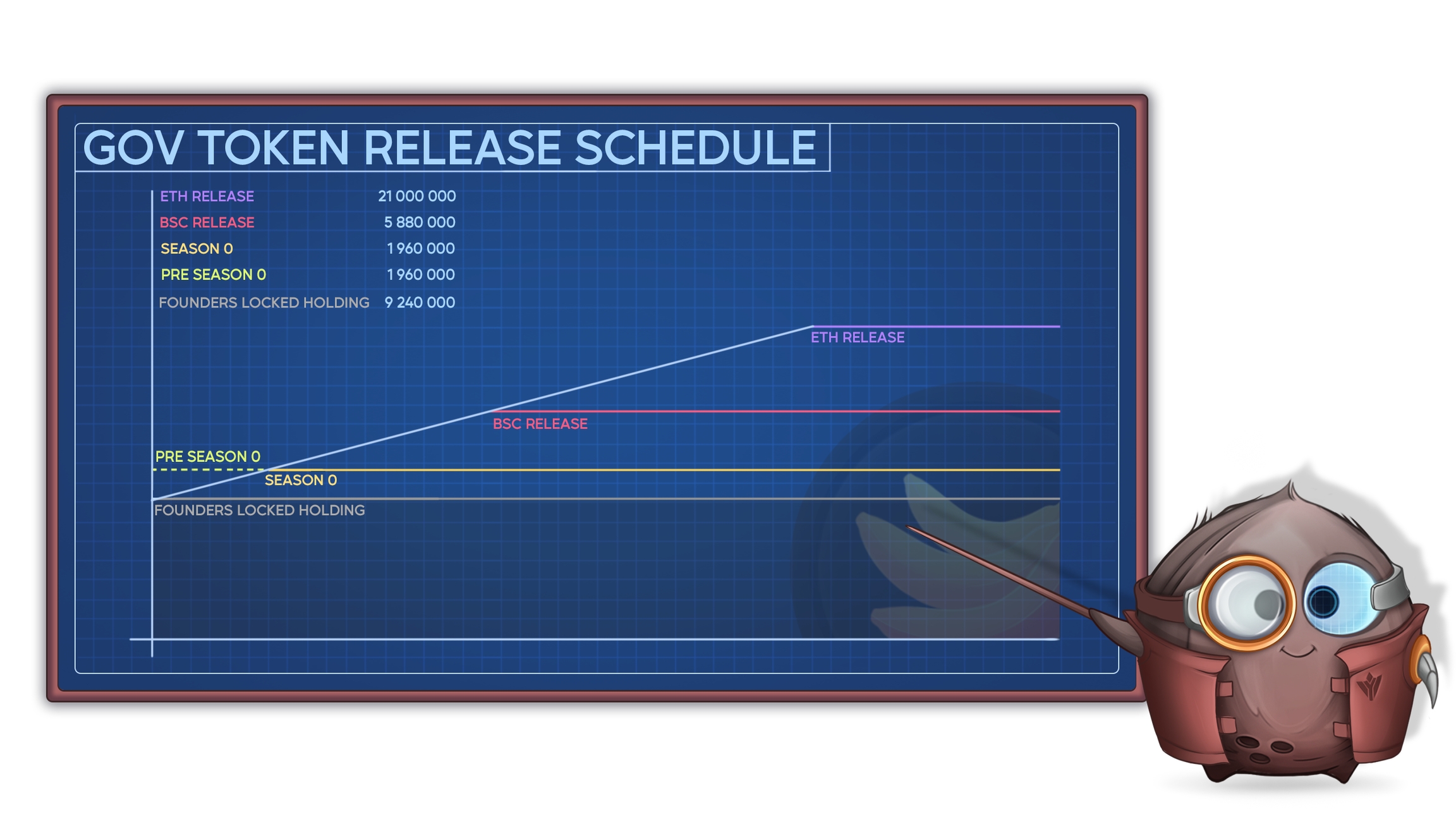

The distribution of the governance tokens is planned as follows:

11,760,000 tokens: Available to the public at a following release schedule:

1,960,000 tokens available before and during Season 0 at 0.045 USDC

5,880,000 tokens (initial S0 supply + up to 3,920,000 tokens) available on BSC cross chain integration, taking into account the projected growth of the projects footprint.

11,760,000 tokens (initial Season 0 supply + up to 3,920,000 tokens + additional 5,880,000 tokens) upon successful Ethereum - Binance Smart Chain - Hedera HashGraph cross chain integration, estimated to occur at the Season 2 onset with adjusted token pricing.

9,240,000 tokens: Original founders, subject to a mandatory 9-month lockup.

Cross-Chain Gov token handling

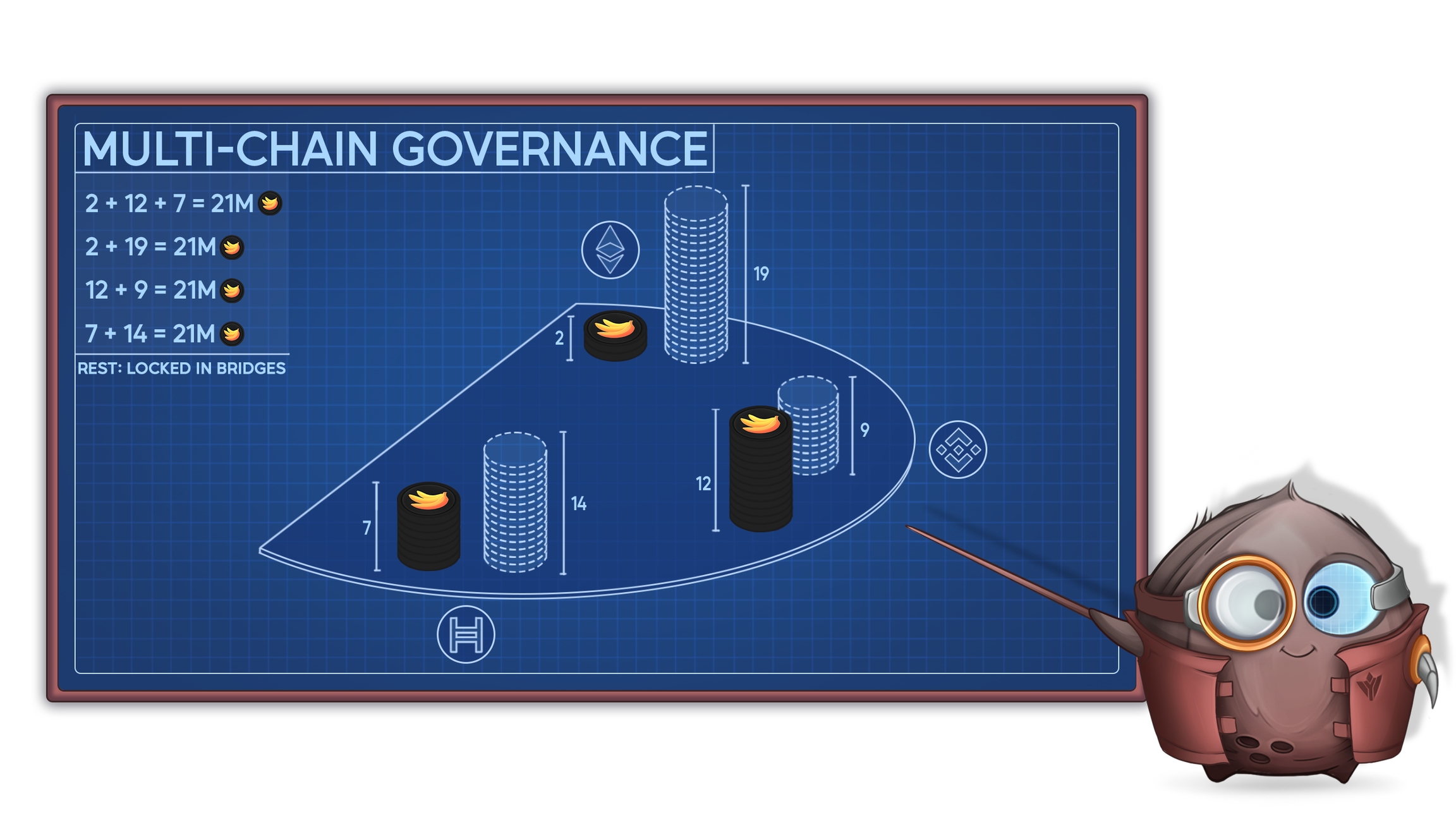

BanCap Gov tokens must be fungible yetm, like NFTs, "singular" in nature. This translates to:

!!! The combined circulating supply of the BanCap Gov tokens across all deployed chains should never exceed 21,000,000 tokens.

To achieve this, we'll use our Hedera Gov Token (HTS) as a "base" 21M and upon every new network connections, the 21M of tokens on a new network will be minted directly into the cross-chain bridge.

By design, at the time of inception of project on a different chain, 100% of tokens will be located on the "chain of origin", users will be able to cross the bridge and park them into Binance Smart Chain reward pool or speculate on them in a different market.

This approach will position BanCap investors on Hedera as true early adpoters for a cross-chain project, ensuring they retain their invested value across the project's various iterations.

Payouts

Given our cross-chain compatible governance token strategy, a distinctive approach to holder payouts is necessary.

Cross-chain Payout Rewards

The key features ofour payout structure are:

Coordinated payouts across all networks.

Oracle-driven balance of reward pool distributions, adjusted by pool allocations.

Flexible payout schedule rotating between gov voting and reward distributions

The decentralized nature of blockchain networks can, in theory, allow an entity to claim rewards on multiple chains. By synchronizing payouts, we mitigate the risk of such "double rewarding", ensuring that no actor can exploit system loopholes for undue advantage.

Given the fluctuating nature of decentralized finance markets, reward pools might see varied contributions. Oracle data helps ensure that rewards are proportionate to a user's contribution and the total pool size, corresponding to BanCap token allocation on specific network.

Token Pre-sale

Recognizing the invaluable support of early adopters, we're extending a unique incentive for those willing to invest in our governance tokens before Season 0. Though we maintain our stance on the token's pricing, we're offering a special 6-month discount on currency purchases for all participants acquiring any quantity of governance tokens directly from our distribution contract.

To facilitate this exclusive "snapshot" mechanism, it necessitates a deviation from utilizing mainstream ICO platforms available on-chain due to security and Hedera imposed restriction on SC and associated Tokens. This minor concession ensures our pioneers are aptly rewarded for their early faith in our project.

Last updated

Was this helpful?