🧑🔬NFT Valuation

A brief examination of various perspectives on NFT valuation

One of the key challenges in the NFT landscape is proving the use case and value of an NFT. Before we get to our own view of the problem, let's recap some commonly used tactics and concepts for NFT Valuation.

"Digital Art" Assets

A prevailing argument suggests that NFTs possess "artistic" value, and as such, should be evaluated accordingly. Indeed, digital art, given its scarcity, commands a price even without a clear use case.

However, this viewpoint encounters a significant hurdle: the limitation of the target audience.

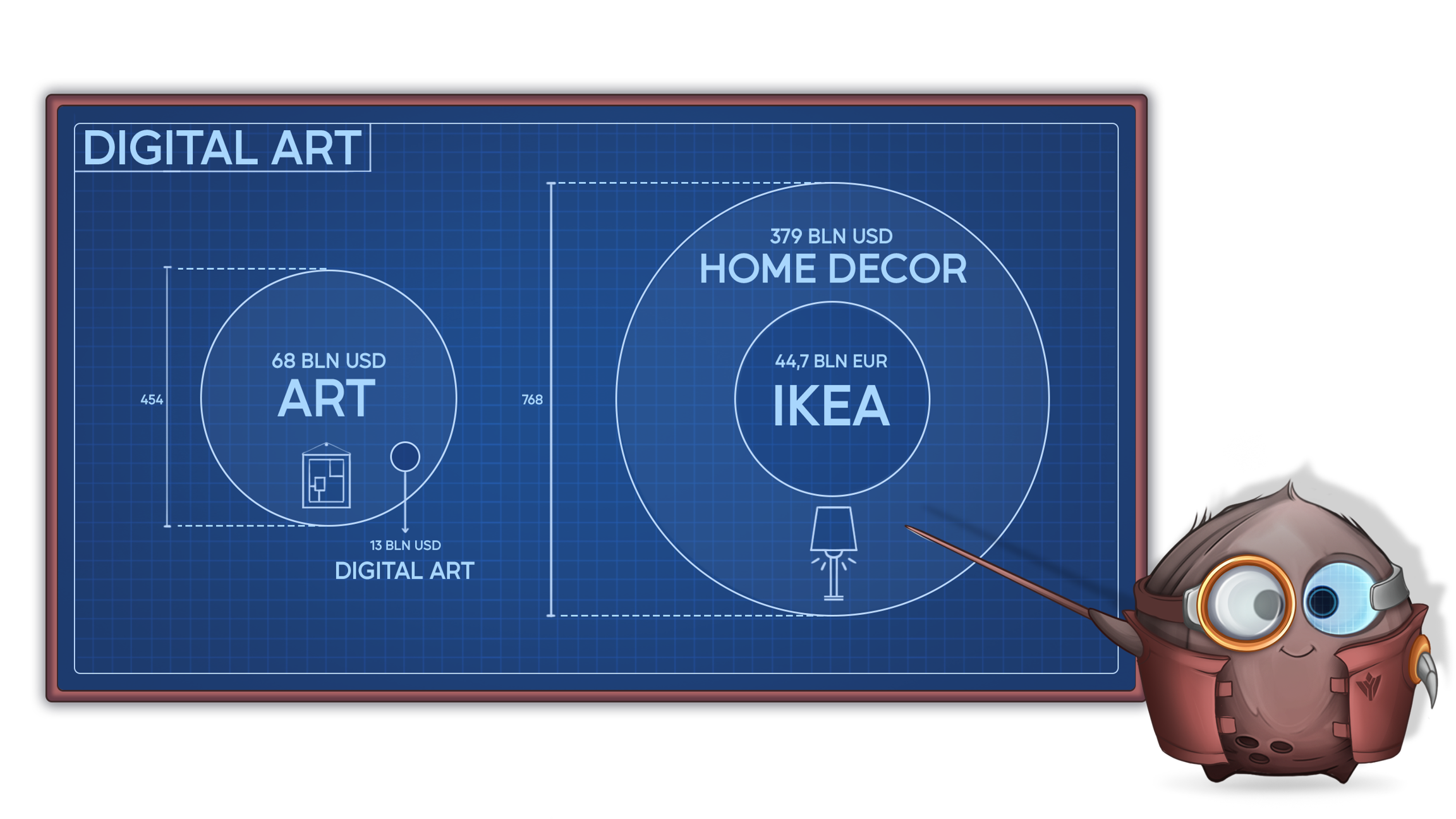

Real life art market is extremely exclusive and by comparison holds insignificant footprint compared to mass markets. In 2022, despite the NFT and digital art slowdown, the global art market generated nearly 68 Billion U.S. dollars. This includes everything from digital art to paintings and even sculptures. By comparison a 2023 Global Home Decor Market report estimates global Decor Market at 739.87 Billion U.S. dollars.

The obvious conclusion is people spend 11x more money on utility oriented Decor (such as useful office table or night stand) than on entirety of contemporary art pieces which often can't be placed in your office or bedroom. Both Auctionata and Ikea offer tables and wall decorations, yet the latter is universally recognized and frequented.

While we could speculate whether IKEAs "fungible" posters and "unique" wall decorations generate more revenue than worldwide painting sales, the overarching conclusion is evident:

A single furniture retailer almost outperforms entire global art market.

Therefore anyone who makes an argument for NFT value being created from "artistic" aspect of digital images instead of mass-market utilitarian approach, argues for NFTs being a subsection of 68bln USD market for isolated buyers instead of breaching the gap to become a digital utility for most. The art/design aspect comes as a bonus.

NFT sales fee redistribution models

More "sophisticated" collections allow holders to profit from token ownership by redistributing sales fees among the collection NFT owners. Simply put, holding a token becomes valuable due to the sales of other tokens within the same collection. Yet, to realize a profit exceeding the initial purchase price, the collection's nominal value and thus the funds pooled by holders must continuously increase... Rings a bell?

A company shares can theoretically "always go up" because the sound business model doesn't rely on future stock sales in order to generate value. Identically, if one was to create an economically sound NFT collection, it's value must originate from some use in a non-zero sum fashion.

Last updated